Adding risk events to the project schedule

‘Risk events’ are events that may, or may not, occur and that have an impact on the project schedule. Risk events are often described as threats if they have increase the risk of failing to meet targets, and opportunities if they reduce that risk.

Tamara provides a rich environment for describing risks (both threats and opportunities). The type of risk event that can be included in Tamara broadly fall into five categories:

-

A risk event resulting in one or more delays to a specific task (for example, material delivery is delayed, equipment must be repaired, or waiting for contractor to arrive)

-

Multiple but identical risk events independently producing the same potential delays to specific tasks (usually a risk that may apply to a set of identical tasks within a project, for example improper connection of the generator on a wind turbine, where there are many wind turbines being constructed in the project)

-

Risk events producing a change in productivity (which may affect many tasks. For example, having to switch to a less competent contractor could reduce productivity levels in several parts of a project)

-

Risk of extra work – sometimes called probabilistic branching (for example, rework of a design, reapplying for a permit)

-

Disruption risk events (risks that will cause a temporary halt to the whole project or some part of it. It causes the same delay to all applicable tasks that are active at the moment the risk event strikes. For example, an earthquake, fire, H&S inspection, or chemical spill that leads to the temporary shutdown of the whole or part of a construction site). Select one of the links to learn how each of these types of risk can be added to your schedule in Tamara.

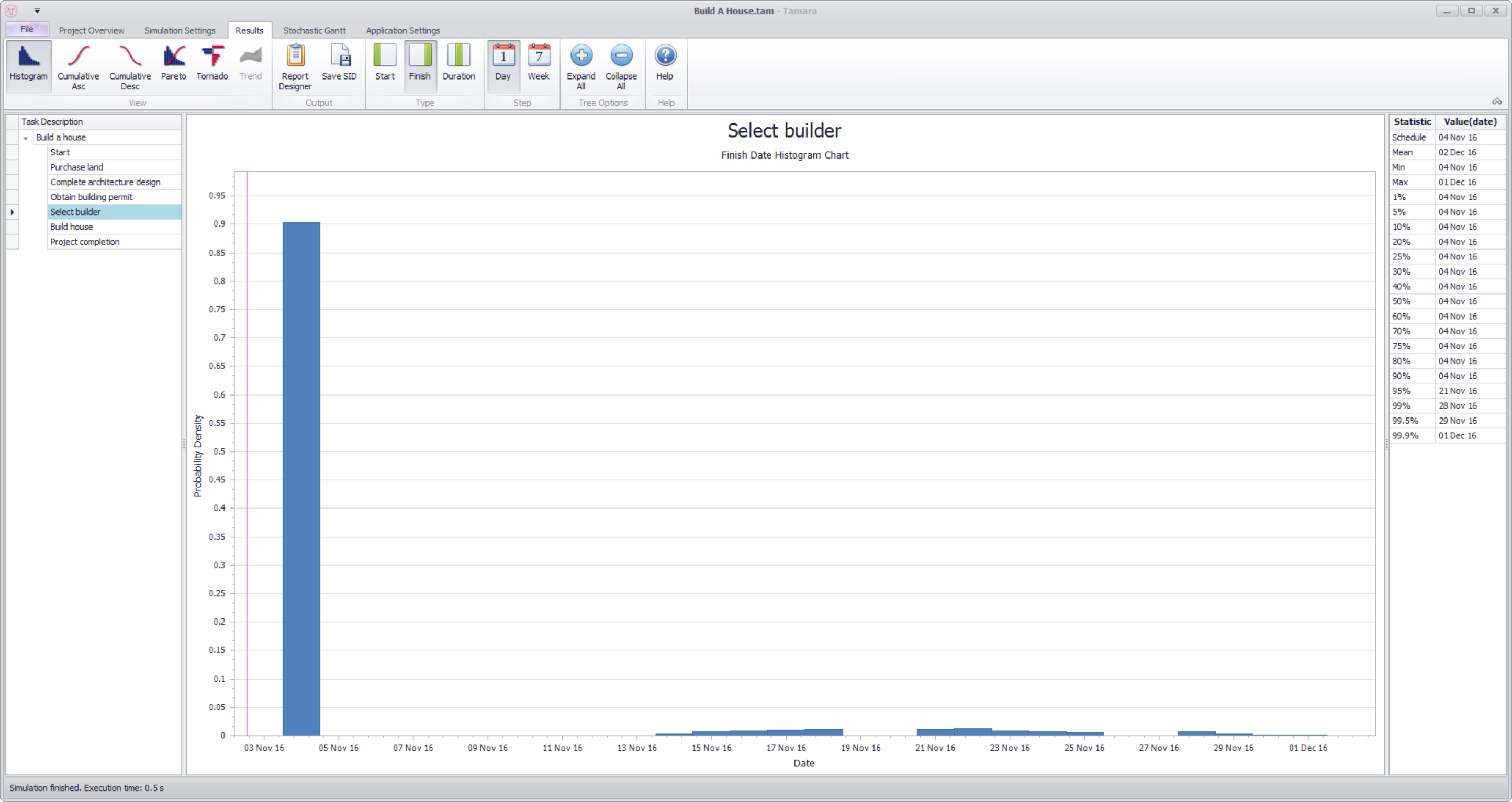

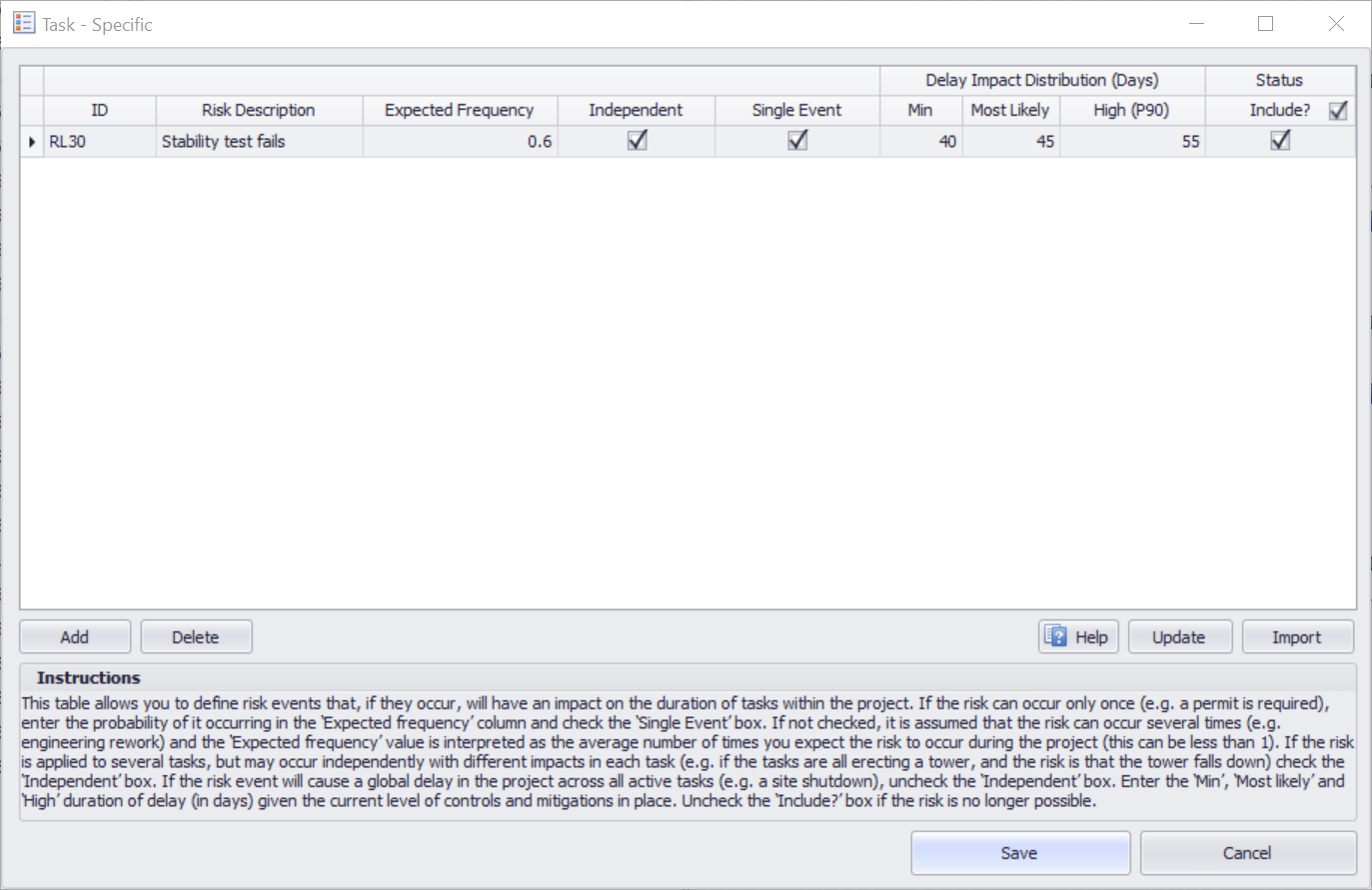

Modeling a risk event resulting in one or more delays to a specific task

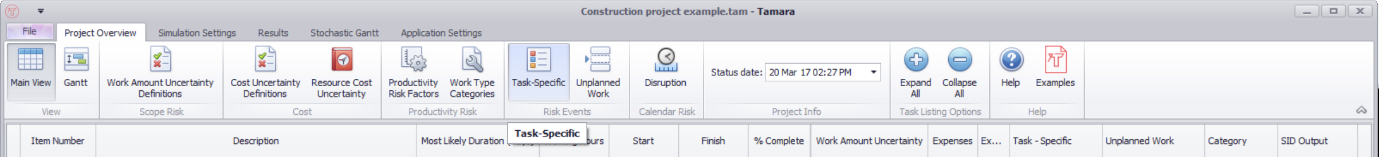

Risk events attached to specific tasks are entered, removed and edited in the Task-specific Risk window, which is accessed by clicking the Task-Specific Risk button in the Project Overview tab:

This opens the following interface:

The table has the following fields:

-

ID – an identification number provided automatically by Tamara. ID numbers apply to individual projects. If a risk is deleted, its ID number is not reused to avoid confusion with older models

-

Risk description – a brief description to help identify the risk

-

Expected frequency – either the probability (between 0 and 1) that the event will occur, if the risk could only occur once, or the expected frequency (greater than 0) if it could occur several times within the project

-

Independent – check this box if the risk can occur in multiple places within the project schedule, but each occurrence is independent of any others – see explanation here

-

Single Event – check this box if the risk can only occur once

-

Delay duration – this is the number of working days of delay that will be experienced in the execution of this task if the risk event occurs. Tamara will automatically include the additional costs associated with any resources dedicated to the task:

-

Delay (min) – the minimum number of days that will be added to the task

-

Delay (most likely) – the most likely number of days that will be added to the task

-

Delay (high P90) – a high estimate of the possible number of days that will be added to the task. There is only a 10% chance that the delay would be longer (i.e. a 90% chance it will be less) should the risk occur

-

-

Additional cost amounts – this is any extra cost that would be incurred if the risk event occurs, excluding the increased use of resources allocated to the task which are already accounted for. It is assumed that these extra costs are unrelated to the length of the delay (i.e. independent):

-

Cost (min) – the minimum additional cost if the risk occurs

-

Cost (most likely) – the most likely additional cost if the risk occurs

-

Cost (high P90) – a high estimate of the possible additional cost if the risk occurs. There is only a 10% chance that the cost would be greater (i.e. a 90% chance it will be less) if the risk occurs

-

-

Include – check this box if the risk should be included in the schedule risk analysis. This is useful if one wants to simulate different scenarios in which some risks are included or exclude, or if the risk is provisional (i.e. we aren’t sure if there is a real issue yet)

Risks can also be imported from Pelican.

Simple example

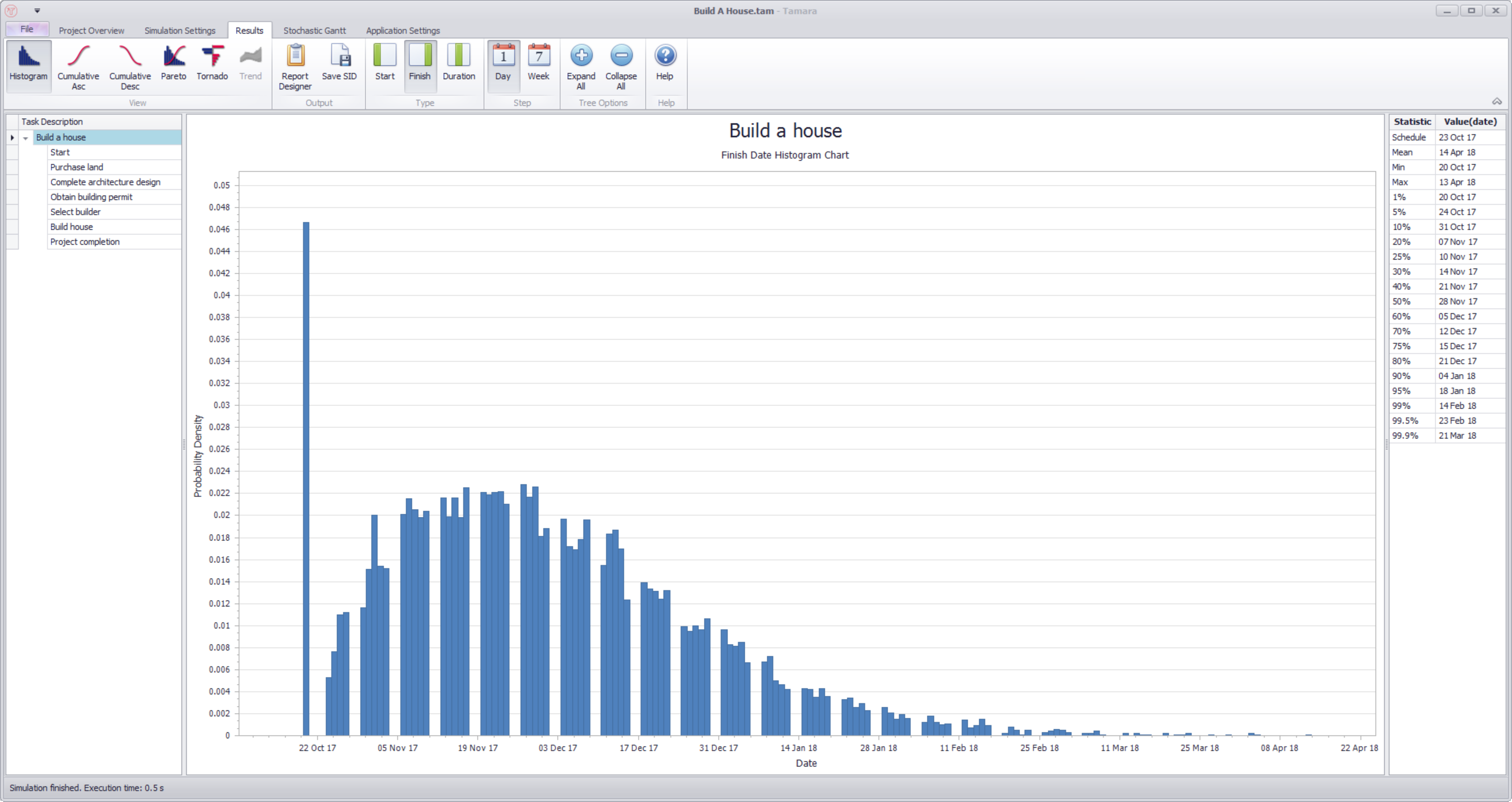

Open the example model called Build a house that comes with Tamara. The base schedule looks as follows:

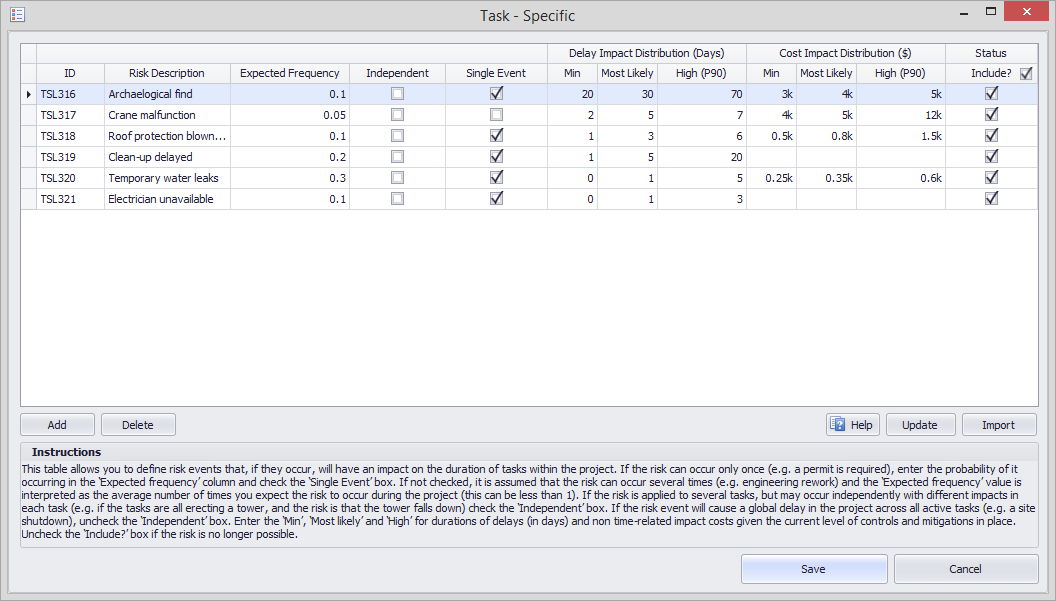

Two risks are to be added to this schedule:

Risk A: The selected builder rejects the initial offer, requiring a renegotiation of the contract. A 10% chance of this occurring, producing (min, most likely, max) = (5,10,20) days delay

Risk B: There are repeated mistakes made by the builder. On average, 3 mistakes are expected, and each one will independently result in (1,5,30) days delay.

These risks are added to the risk register, accessed by selecting the Risk Register icon from Tamara’s Task Overview menu:

Risk A, builder rejects offer, is a single event (i.e. it will only occur once, if at all). The 10% probability is entered in the Expected frequency field, and the minimum, most likely and maximum delays of (5,10,20) entered in their respective fields. The risk is live (i.e. still exists) so the Include? box is checked.

Risk B, mistakes by builder, is not a single event (i.e. several events can occur). The average number of expected events (3) is entered in the Expected Frequency field, and the minimum, most likely and maximum delays of (1,5,30) for a single mistake are entered in their respective fields. The risk is live (i.e. still exists) so the Include? box is checked.

These risks are now connected to the schedule by selecting them in the Risk Register column of the Main View window:

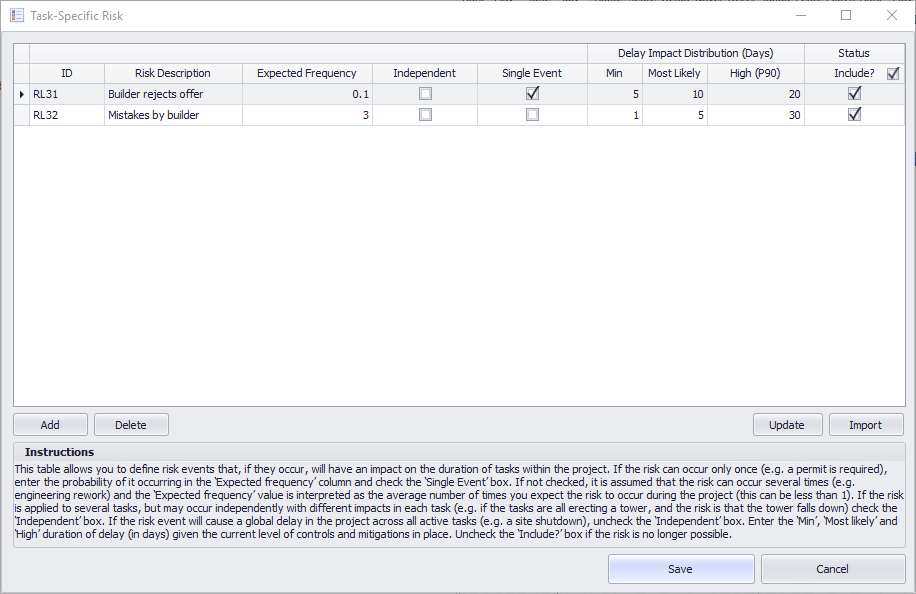

Looking at the simulation results, we see the duration of Select builder, which was originally 10 days but now has Risk A applied to it, has the following distribution:

There is a 90% chance it is still 10 days (Risk A doesn’t occur), but a 10% chance it lies somewhere between 15 and 28 days (equating to a delay of between 5 and 20 days).

The duration of Build house, which was originally 250 days but now has Risk B applied to it, has the following distribution:

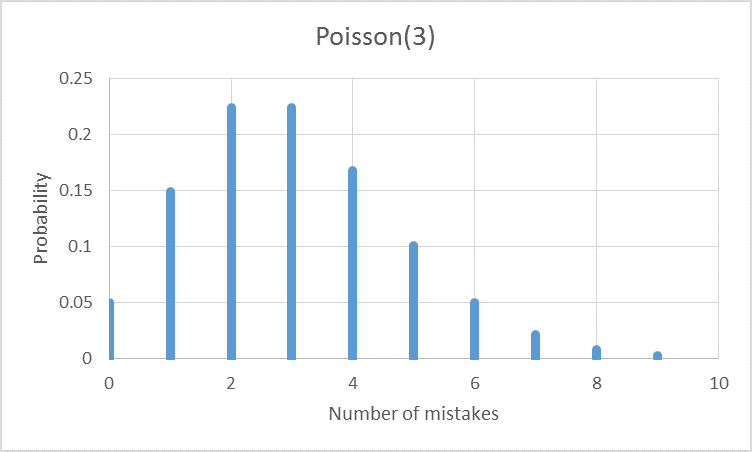

It was estimated that the builder would make 3 mistakes on average, each producing a delay of (1,5,30) days. Internally, the actual number of mistakes was simulated by Tamara using a Poisson(3) distribution:

The Poisson distribution shows that there is about a 5% chance that no mistakes will be made, which is why the results show about a 5% chance of the task taking the original 250 days. Internally, Tamara used the following distribution to model the delay from a single mistake:

The mean of this distribution is 9.2 days, so on average (statistically) we would expect to have 3 * 9.2 = 27.6 days of delay, taking the total duration to 277.6 days, which you can see is about the center of gravity of the simulation results histogram.

Modeling multiple but identical risk events independently producing the same potential delays to specific tasks

Many projects involve repeating the same set of tasks multiple times. For example, the set of tasks could be:

-

To build an overpass bridge (there may be several such bridges for a motorway or railway line construction project);

-

To erect a wind turbine (there may be many wind turbines built for a wind farm construction project);

-

To inspect pylons of a certain type (there will be many pylons to inspect for a complete transmission line refit project); or

-

To install a pre-built bathroom (there may be two or more bathrooms for each floor of an office tower block construction project)

It is often the case that there are risks associated with such sets of tasks that similarly are repeatable. For example, each time a wind turbine is installed there might be a risk of the generator being faulty, or a crane failing, or connectors being fitted incorrectly, or bearings being misaligned. If one was building a farm of many turbines, such a risk event could happen to each turbine, or some, or none.

Tamara allows you to enter such a risk event a single time, rather than create a separate identical risk event for each place in the project it could occur. This reduces the work required to set up a schedule risk model and makes it very easy to adjust the probability or impact sizes since they are located in one single place.

In order to use this feature, one enters the risk event into the Task-Specific Risk table, and additionally checking the Independent box.

Risks can also be imported from Pelican.

Example

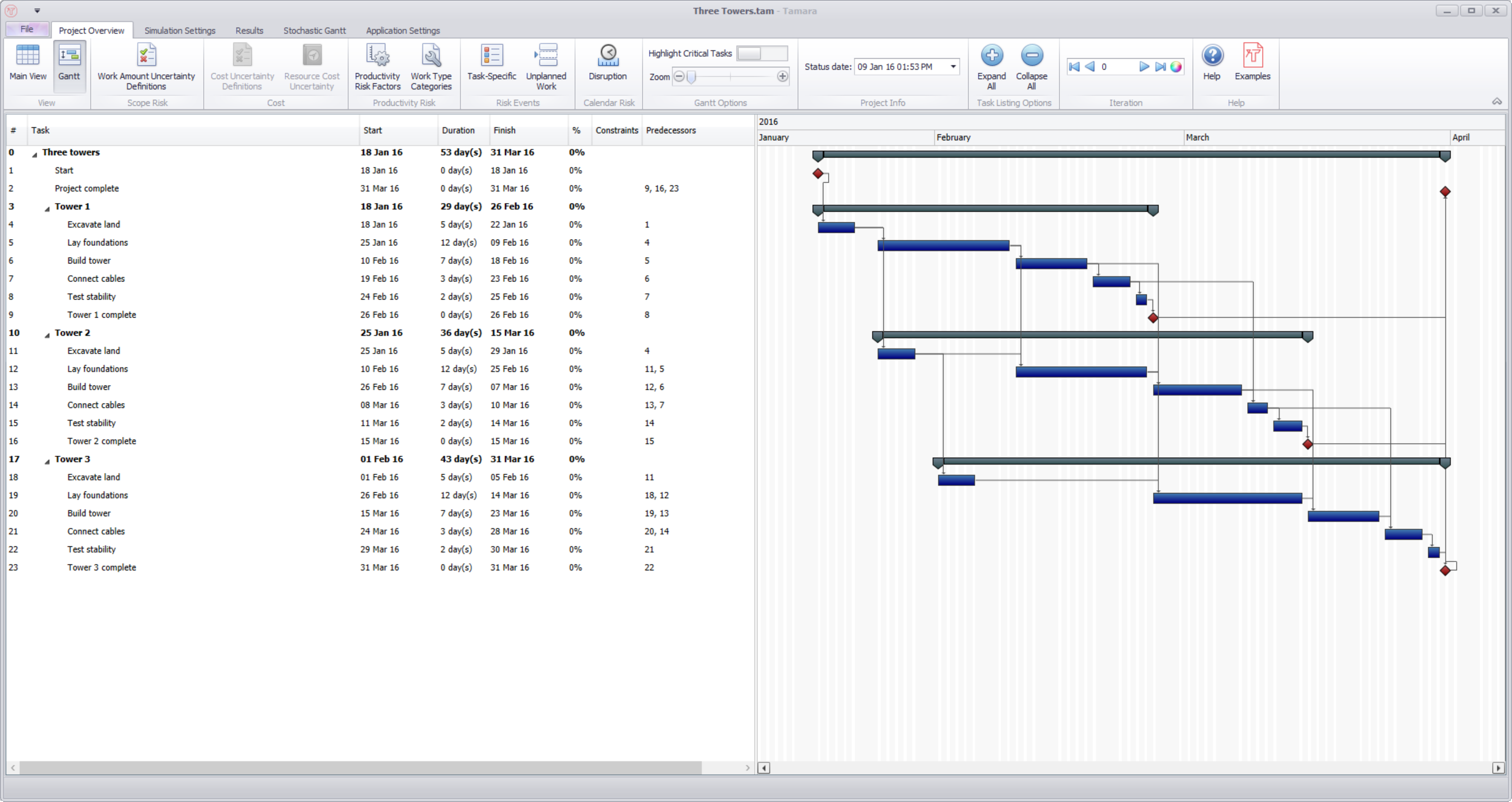

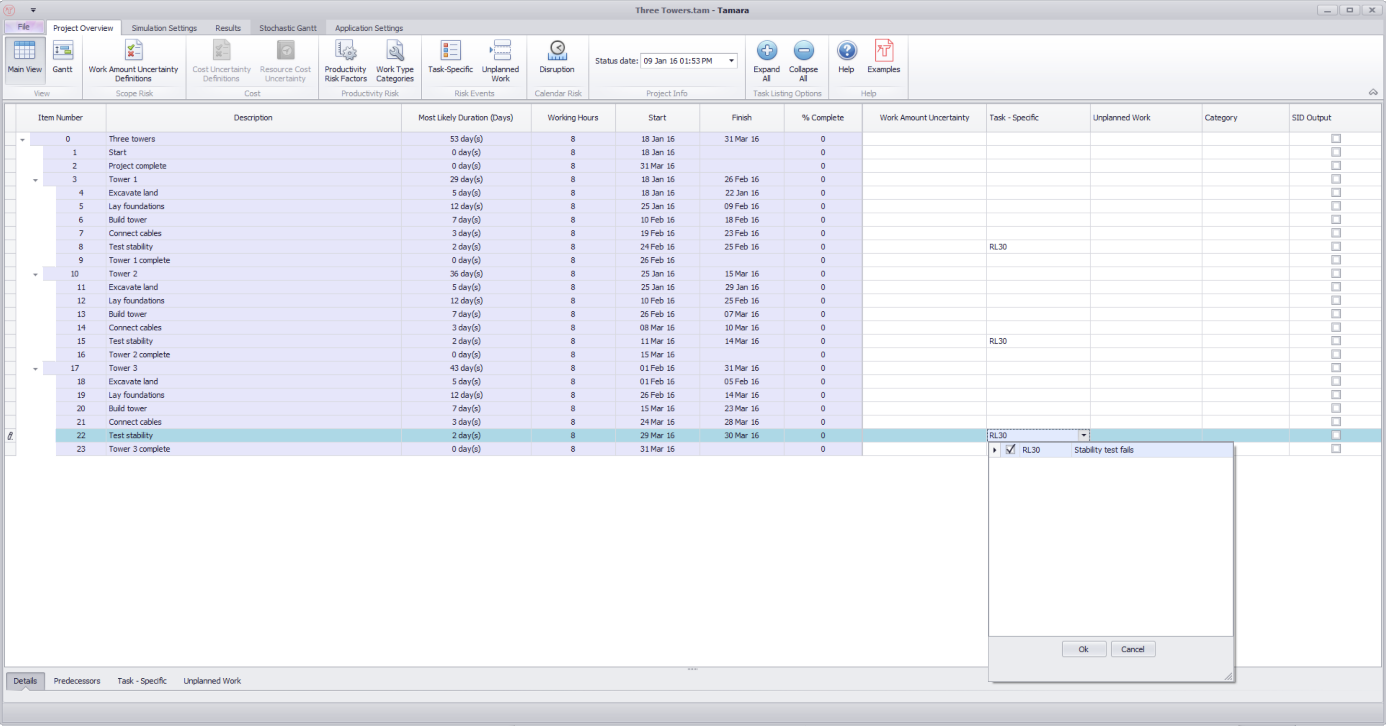

You can follow this example by loading the file ‘Three Towers’ from the examples folder. In the following project, three electric cable towers (pylons) are to be built and connected together:

For each task, the same specialist team is used so, for example, land excavation on Tower 2 starts after the excavation on Tower 1 finishes, etc.

This project represents a set of tasks repeated for each tower and therefore the construction of each tower shares duplicates of the same potential risks as the others.

We will add a risk that, when stability for a tower is tested, it fails with 60% probability and would then produce a delay of (40,45,55) days:

Now we link the risk to each Test stability task:

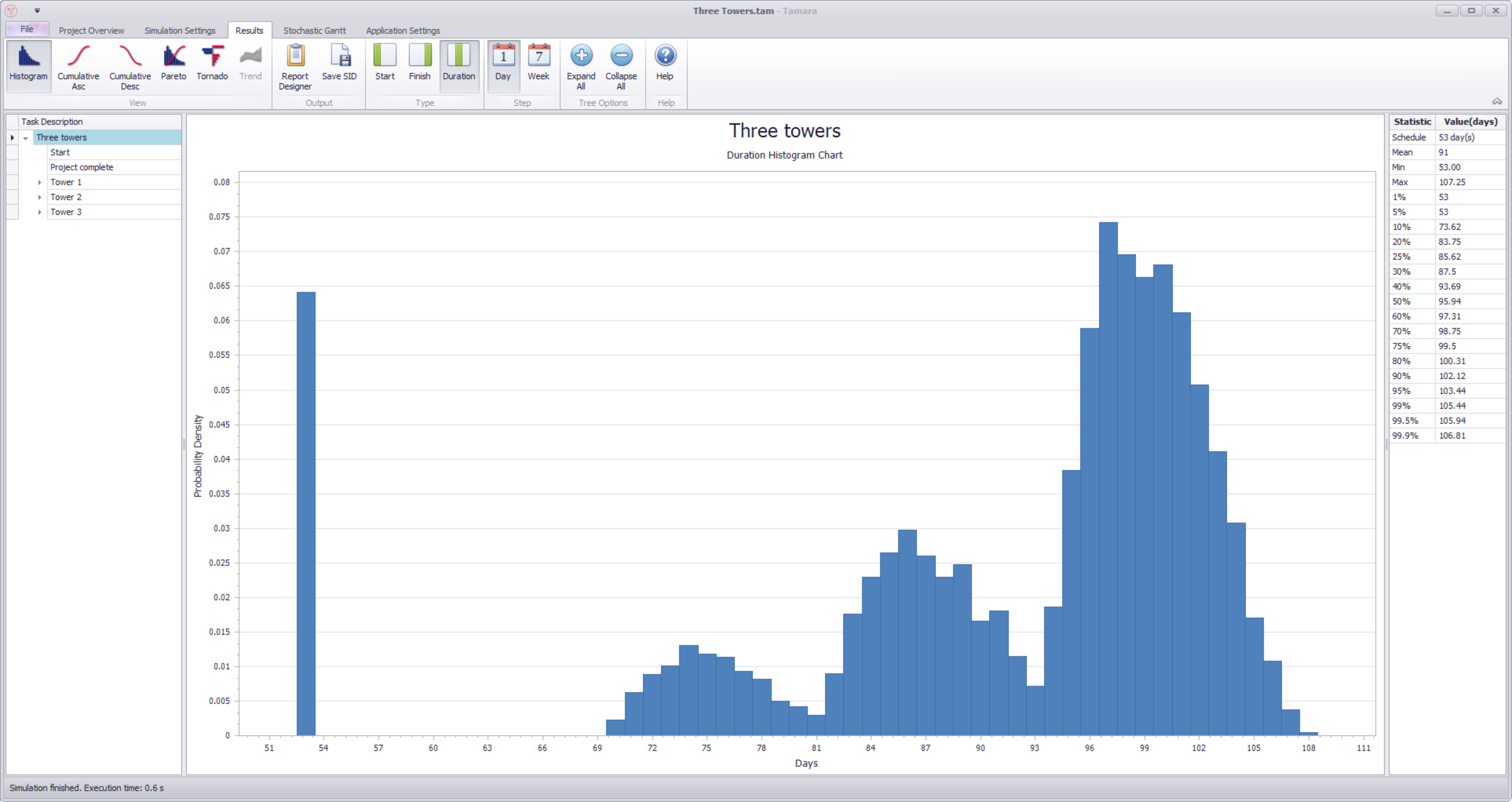

This means that there are three independent chances for this risk to occur, each with 60% probability. There is therefore only 40% * 40% * 40% = 6.4% chance that the risk does not occur at all. Without the risks included, the project duration was 53 days. The simulation result shows this not has only a 6.4% chance of occurring as expected:

You can also see three slightly overlapping distributions, representing whether the risk event occurs 1, 2, or 3 times.

Modeling the risk of a change in productivity

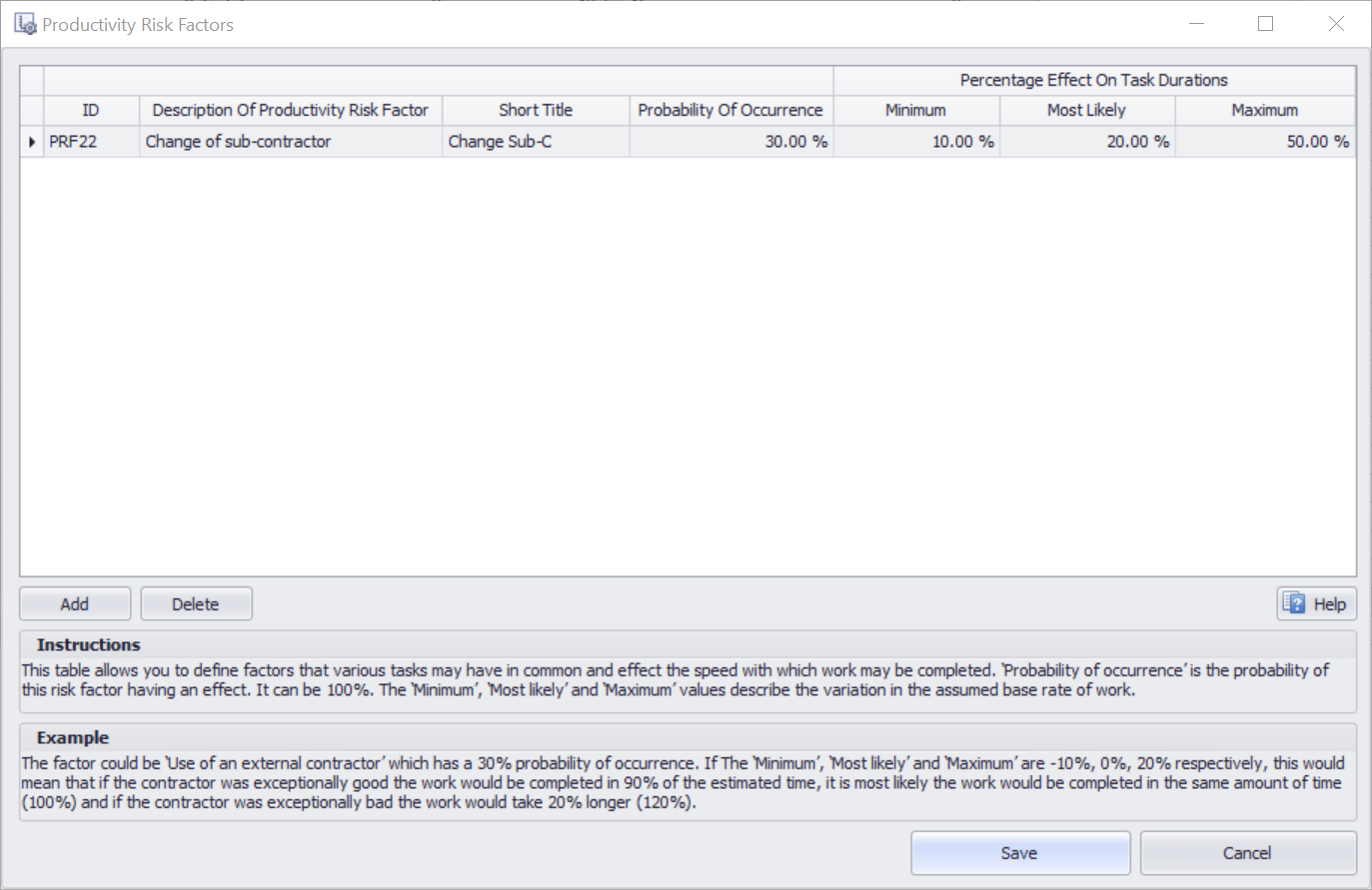

In the Productivity Risk Factor dialog, one can enter a risk event that affects productivity. For example:

You plan to use a particular experienced sub-contractor for completing some tasks in the project. However, it is estimated that there is a 30% probability that this sub-contractor is unavailable, in which case you will have to revert to a second sub-contractor who will take between 10% and 50% longer to complete the tasks, most likely 20%.

The risk is entered as follows:

You can add this productivity risk factor to a Work Type Category. Then, for each task to which that Work Type Category has been assigned, Tamara will simulate the risk event so that it occurs 30% of generated scenarios, and when it does occur adds between 10% and 50%, most likely 20% to the estimated duration of the tasks.

Modelling the risk of additional work

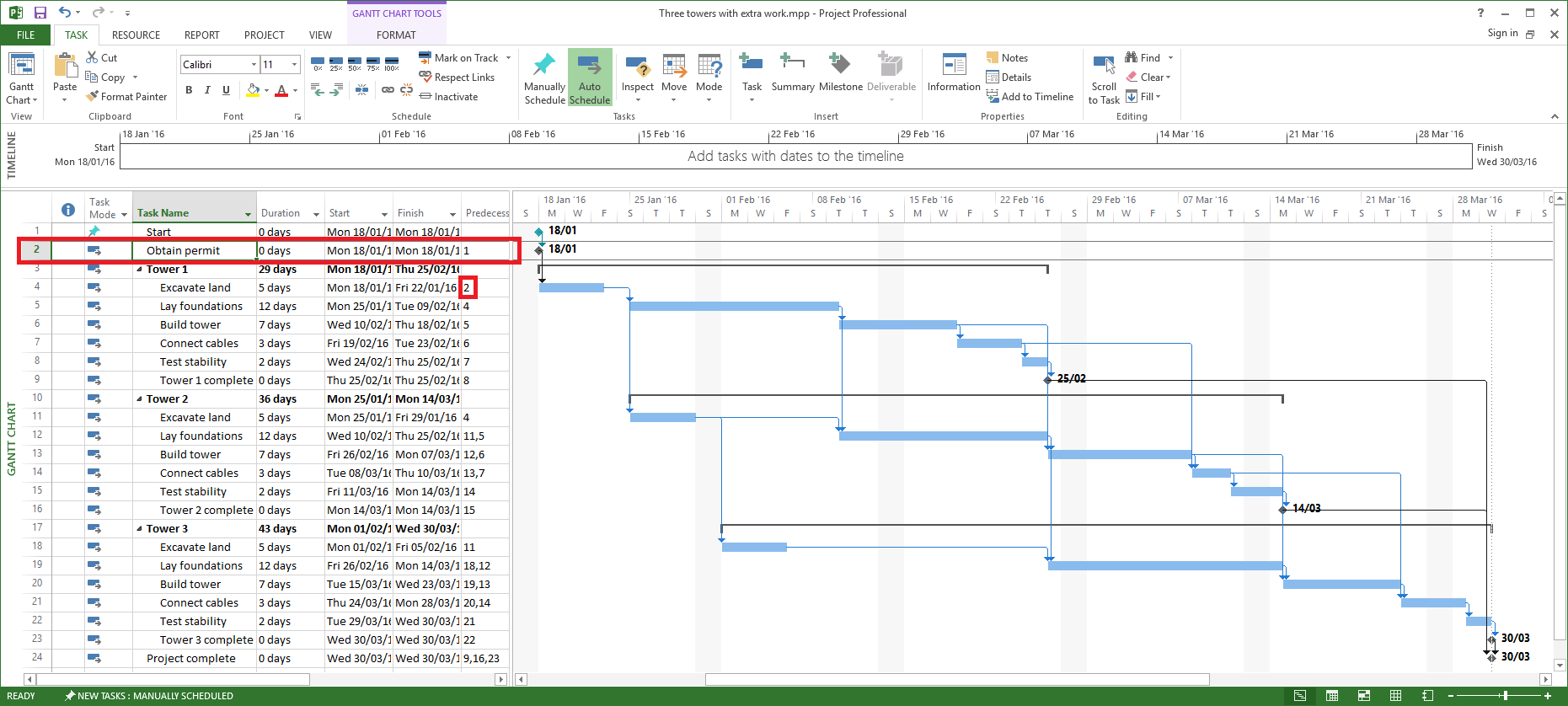

Tamara also includes the capability of adding new tasks to a schedule as a result of a risk event occurring, a technique often called probabilistic branching. This is illustrated with an example model called ‘Three towers with extra work’ that comes with Tamara.

In this example, there is a 20% probability that it will be necessary to obtain a permit from the local authority before beginning construction, which would take between 20 and 40, most likely 25 days.

We must first include the possible extra task(s) in the base schedule model, including all the antecedents and precedent logical links. It is best practice to set the duration to zero. For example, in MS Project, Task 2 Obtain permit has been added to the schedule:

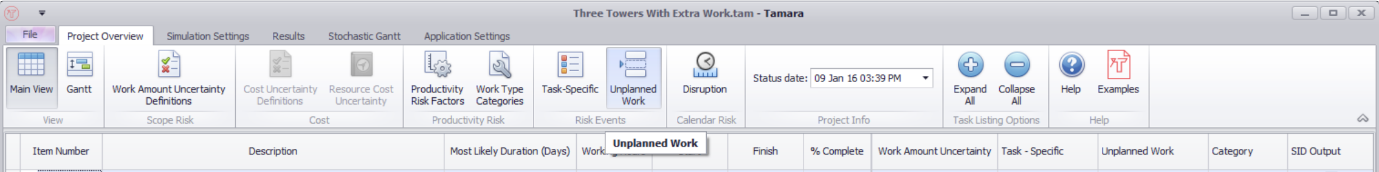

MS Project interprets this as a milestone by default because of the zero duration, so we must . Note that Task 4 (Tower 1 Excavate land) has Obtain permit as its predecessor, so if Tamara changes the duration of Task 2 it will affect the rest of the schedule. After importing this model to Tamara, you need to define an Unplanned Work event by clicking the Unplanned Work button in the Task Overview tab:

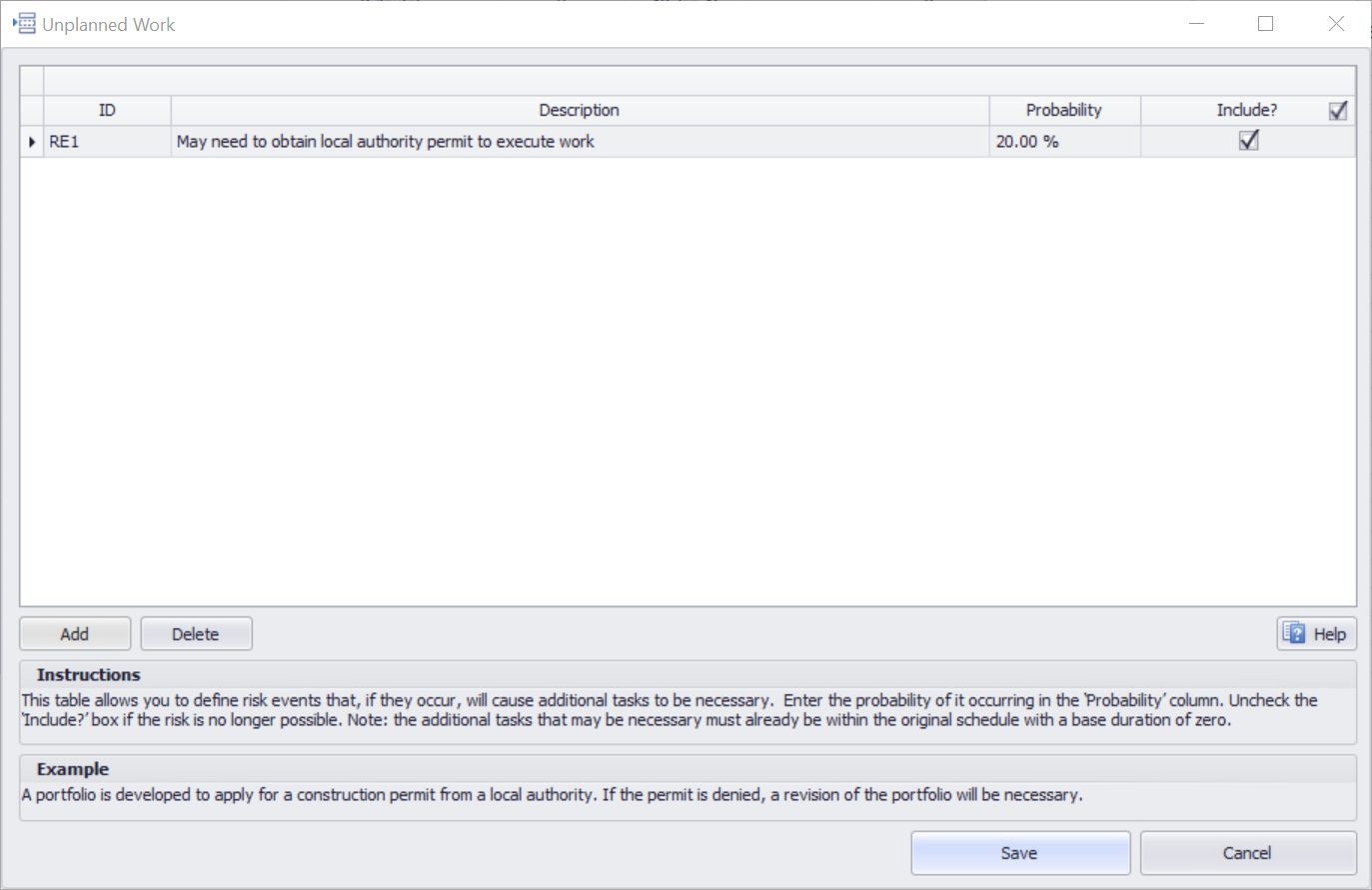

This opens the following window, where you click Add, enter a description and a probability of occurrence, and then Save:

You can add more, and delete, unplanned work risk events by clicking the appropriate buttons. The table has the following fields:

-

ID – an identification number provided automatically by Tamara. If a risk existence is deleted, its ID number is not reused

-

Risk description – a brief description to help identify the risk

-

Probability – the probability (between 0 and 1) that the risk event will occur

-

Include? – check this box if the risk event should be included in the schedule risk analysis. This is useful if one wants to simulate different scenarios in which some risks are included or exclude, or if the risk is provisional (i.e. we aren’t sure if there is a real issue yet)

Then we connect the Unplanned Work event to the schedule, by selecting the event from those listed in the Unplanned Work field for the Obtain permit task:

Finally, we need to specify what the duration will be when this event occurs, by selecting the corresponding cell in the Work Amount Uncertainty column, choose Custom, and enter the duration the task will take in days (a percentage variation from Base will not work since this is zero). Negative values are not allowed since they would break the logic of the base schedule:

During a simulation, Tamara will randomly generate scenarios in which the unplanned work event occurs (with the probability defined) or does not occur. In a random sample where the unplanned work event occurs, all tasks connected to that particular unplanned work event will be simulated to occur together. In a random sample where the unplanned work event does not occur, the schedule dependency logic is maintained but the connected tasks are given a duration of zero. You can attach multiple unplanned work events to a single task, in which case the task will take a non-zero value if at least one of the risk existence events is simulated to occur.

In the worked example, the distribution of the duration for the Obtain permit task looks as follows:

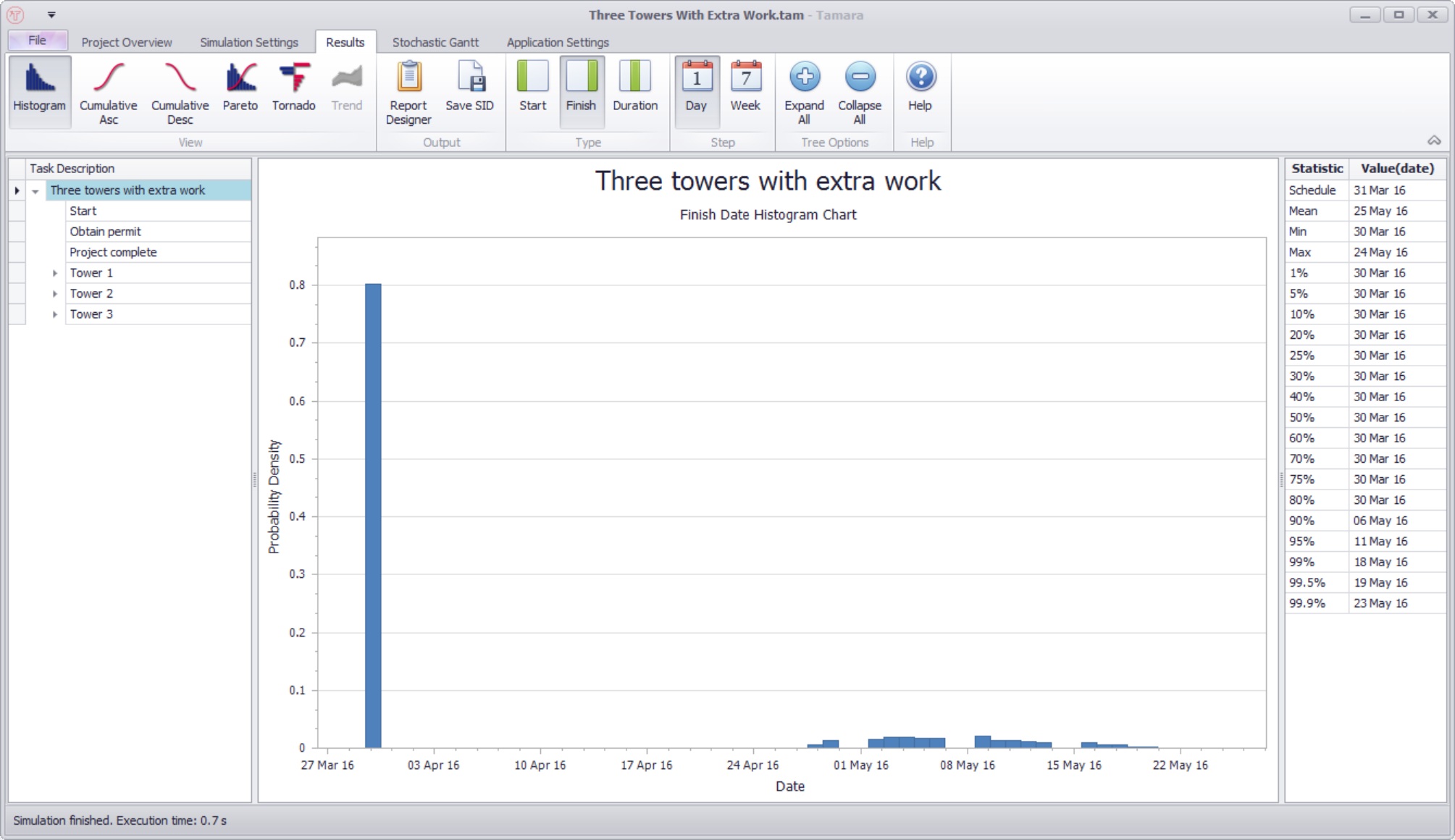

There is an 80% probability it is zero (i.e. the risk event did not occur), and the remaining 20% is spread between 20 and 40 days. This results in a project completion date as follows:

The example model ‘Commercial Construction’ illustrates another application of the risk existence method.

Modeling disruption risk events

Disruption risk events temporarily stop all activity across the whole project, or across a section of the project. Disruption risks are connected to moments in time, not to individual tasks. In other words, whether these disruption risk events occur or not does not depend on which tasks are currently active in the project. Examples are:

-

Partial site shutdown due to earthquake, strike, or security breach;

-

Entire project postponement due to legal dispute or funding issue;

-

All contractor work halted due to discovery of illegal workers; or

-

Construction work halted pending H&S investigation of an accident

Tamara allows you to incorporate the occurrence of such risks using the Disruption table, which has the following fields:

-

ID – an identification number provided automatically by Tamara. ID numbers apply to individual projects. If a risk is deleted, its ID number is not reused to avoid confusion with older models

-

Risk description – a brief description to help identify the risk

-

Frequency –either the expected frequency of the number of risk events that may occur during the defined period if the risk event is repeatable (Single Event parameter is not ticked). For example, a strike or an earthquake may occur more than once, but a building collapse cannot; or the probability of an unrepeatable risk event occurring (Single Event parameter is ticked), e.g. a building collapse.

-

Single Event – ticking this box means that the risk can occur only once

-

Overlap – ticking this box means that if the risk event is repeatable, a second event can occur while one is still suffering from the delay caused by the first event

-

Delay (min) – the minimum number of days that the project or sub-project will be suspended

-

Delay (most likely) – the most likely number of days that the project or sub-project will be suspended

-

Delay (high P90) – a high estimate of the possible number of days that the project or sub-project will be suspended. There is only a 10% chance that the delay would be longer (i.e. a 90% chance it will be less) should the risk occur

-

Start – the starting date of the defined period

-

Finish – the finish date of the defined period

-

Calendar – the calendar against which the delays will be added. Any tasks that share this calendar and are active at the moment a suspension risk event occurs will be delayed by the same amount of time

-

Include? – check this box if the suspension risk should be included in the schedule risk analysis. This is useful if one wants to simulate different scenarios in which some risks are included or exclude, or if the risk is provisional (i.e. one isn’t sure if this is a real issue yet)

Risks can also be imported from Pelican.

The example model Construction project example includes some disruption risks:

The first three suspension risks are storms that could occur between May and July each year of the project. They don’t overlap as one storm must finish before another starts, and there are expected to be on average 4 storms within the May to July window each year.

The Earthquake suspension risk is expected to occur twice over nearly 2.5 years, with delays of 0-10 days. The delays can overlap – meaning that whilst one is recovering from the effects of a first earthquake, a second could occur.

Finally, the contractor quitting suspension risk has a 5% chance of occurring, can only happen once (single event) – which also means that whether the overlap parameter is checked or not is irrelevant – and will cause a delay to the whole project of 30-80 days if it occurs.

Navigation

- Risk management

- Risk management introduction

- What are risks and opportunities?

- Planning a risk analysis

- Clearly stating risk management questions

- Evaluating risk management options

- Introduction to risk analysis

- The quality of a risk analysis

- Using risk analysis to make better decisions

- Explaining a models assumptions

- Statistical descriptions of model outputs

- Simulation Statistical Results

- Preparing a risk analysis report

- Graphical descriptions of model outputs

- Presenting and using results introduction

- Statistical descriptions of model results

- Mean deviation (MD)

- Range

- Semi-variance and semi-standard deviation

- Kurtosis (K)

- Mean

- Skewness (S)

- Conditional mean

- Custom simulation statistics table

- Mode

- Cumulative percentiles

- Median

- Relative positioning of mode median and mean

- Variance

- Standard deviation

- Inter-percentile range

- Normalized measures of spread - the CofV

- Graphical descriptionss of model results

- Showing probability ranges

- Overlaying histogram plots

- Scatter plots

- Effect of varying number of bars

- Sturges rule

- Relationship between cdf and density (histogram) plots

- Difficulty of interpreting the vertical scale

- Stochastic dominance tests

- Risk-return plots

- Second order cumulative probability plot

- Ascending and descending cumulative plots

- Tornado plot

- Box Plot

- Cumulative distribution function (cdf)

- Probability density function (pdf)

- Crude sensitivity analysis for identifying important input distributions

- Pareto Plot

- Trend plot

- Probability mass function (pmf)

- Overlaying cdf plots

- Cumulative Plot

- Simulation data table

- Statistics table

- Histogram Plot

- Spider plot

- Determining the width of histogram bars

- Plotting a variable with discrete and continuous elements

- Smoothing a histogram plot

- Risk analysis modeling techniques

- Monte Carlo simulation

- Monte Carlo simulation introduction

- Monte Carlo simulation in ModelRisk

- Filtering simulation results

- Output/Input Window

- Simulation Progress control

- Running multiple simulations

- Random number generation in ModelRisk

- Random sampling from input distributions

- How many Monte Carlo samples are enough?

- Probability distributions

- Distributions introduction

- Probability calculations in ModelRisk

- Selecting the appropriate distributions for your model

- List of distributions by category

- Distribution functions and the U parameter

- Univariate continuous distributions

- Beta distribution

- Beta Subjective distribution

- Four-parameter Beta distribution

- Bradford distribution

- Burr distribution

- Cauchy distribution

- Chi distribution

- Chi Squared distribution

- Continuous distributions introduction

- Continuous fitted distribution

- Cumulative ascending distribution

- Cumulative descending distribution

- Dagum distribution

- Erlang distribution

- Error distribution

- Error function distribution

- Exponential distribution

- Exponential family of distributions

- Extreme Value Minimum distribution

- Extreme Value Maximum distribution

- F distribution

- Fatigue Life distribution

- Gamma distribution

- Generalized Extreme Value distribution

- Generalized Logistic distribution

- Generalized Trapezoid Uniform (GTU) distribution

- Histogram distribution

- Hyperbolic-Secant distribution

- Inverse Gaussian distribution

- Johnson Bounded distribution

- Johnson Unbounded distribution

- Kernel Continuous Unbounded distribution

- Kumaraswamy distribution

- Kumaraswamy Four-parameter distribution

- Laplace distribution

- Levy distribution

- Lifetime Two-Parameter distribution

- Lifetime Three-Parameter distribution

- Lifetime Exponential distribution

- LogGamma distribution

- Logistic distribution

- LogLaplace distribution

- LogLogistic distribution

- LogLogistic Alternative parameter distribution

- LogNormal distribution

- LogNormal Alternative-parameter distribution

- LogNormal base B distribution

- LogNormal base E distribution

- LogTriangle distribution

- LogUniform distribution

- Noncentral Chi squared distribution

- Noncentral F distribution

- Normal distribution

- Normal distribution with alternative parameters

- Maxwell distribution

- Normal Mix distribution

- Relative distribution

- Ogive distribution

- Pareto (first kind) distribution

- Pareto (second kind) distribution

- Pearson Type 5 distribution

- Pearson Type 6 distribution

- Modified PERT distribution

- PERT distribution

- PERT Alternative-parameter distribution

- Reciprocal distribution

- Rayleigh distribution

- Skew Normal distribution

- Slash distribution

- SplitTriangle distribution

- Student-t distribution

- Three-parameter Student distribution

- Triangle distribution

- Triangle Alternative-parameter distribution

- Uniform distribution

- Weibull distribution

- Weibull Alternative-parameter distribution

- Three-Parameter Weibull distribution

- Univariate discrete distributions

- Discrete distributions introduction

- Bernoulli distribution

- Beta-Binomial distribution

- Beta-Geometric distribution

- Beta-Negative Binomial distribution

- Binomial distribution

- Burnt Finger Poisson distribution

- Delaporte distribution

- Discrete distribution

- Discrete Fitted distribution

- Discrete Uniform distribution

- Geometric distribution

- HypergeoM distribution

- Hypergeometric distribution

- HypergeoD distribution

- Inverse Hypergeometric distribution

- Logarithmic distribution

- Negative Binomial distribution

- Poisson distribution

- Poisson Uniform distribution

- Polya distribution

- Skellam distribution

- Step Uniform distribution

- Zero-modified counting distributions

- More on probability distributions

- Multivariate distributions

- Multivariate distributions introduction

- Dirichlet distribution

- Multinomial distribution

- Multivariate Hypergeometric distribution

- Multivariate Inverse Hypergeometric distribution type2

- Negative Multinomial distribution type 1

- Negative Multinomial distribution type 2

- Multivariate Inverse Hypergeometric distribution type1

- Multivariate Normal distribution

- More on probability distributions

- Approximating one distribution with another

- Approximations to the Inverse Hypergeometric Distribution

- Normal approximation to the Gamma Distribution

- Normal approximation to the Poisson Distribution

- Approximations to the Hypergeometric Distribution

- Stirlings formula for factorials

- Normal approximation to the Beta Distribution

- Approximation of one distribution with another

- Approximations to the Negative Binomial Distribution

- Normal approximation to the Student-t Distribution

- Approximations to the Binomial Distribution

- Normal_approximation_to_the_Binomial_distribution

- Poisson_approximation_to_the_Binomial_distribution

- Normal approximation to the Chi Squared Distribution

- Recursive formulas for discrete distributions

- Normal approximation to the Lognormal Distribution

- Normal approximations to other distributions

- Approximating one distribution with another

- Correlation modeling in risk analysis

- Common mistakes when adapting spreadsheet models for risk analysis

- More advanced risk analysis methods

- SIDs

- Modeling with objects

- ModelRisk database connectivity functions

- PK/PD modeling

- Value of information techniques

- Simulating with ordinary differential equations (ODEs)

- Optimization of stochastic models

- ModelRisk optimization extension introduction

- Optimization Settings

- Defining Simulation Requirements in an Optimization Model

- Defining Decision Constraints in an Optimization Model

- Optimization Progress control

- Defining Targets in an Optimization Model

- Defining Decision Variables in an Optimization Model

- Optimization Results

- Summing random variables

- Aggregate distributions introduction

- Aggregate modeling - Panjer's recursive method

- Adding correlation in aggregate calculations

- Sum of a random number of random variables

- Moments of an aggregate distribution

- Aggregate modeling in ModelRisk

- Aggregate modeling - Fast Fourier Transform (FFT) method

- How many random variables add up to a fixed total

- Aggregate modeling - compound Poisson approximation

- Aggregate modeling - De Pril's recursive method

- Testing and modeling causal relationships

- Stochastic time series

- Time series introduction

- Time series in ModelRisk

- Autoregressive models

- Thiel inequality coefficient

- Effect of an intervention at some uncertain point in time

- Log return of a Time Series

- Markov Chain models

- Seasonal time series

- Bounded random walk

- Time series modeling in finance

- Birth and death models

- Time series models with leading indicators

- Geometric Brownian Motion models

- Time series projection of events occurring randomly in time

- Simulation for six sigma

- ModelRisk's Six Sigma functions

- VoseSixSigmaCp

- VoseSixSigmaCpkLower

- VoseSixSigmaProbDefectShift

- VoseSixSigmaLowerBound

- VoseSixSigmaK

- VoseSixSigmaDefectShiftPPMUpper

- VoseSixSigmaDefectShiftPPMLower

- VoseSixSigmaDefectShiftPPM

- VoseSixSigmaCpm

- VoseSixSigmaSigmaLevel

- VoseSixSigmaCpkUpper

- VoseSixSigmaCpk

- VoseSixSigmaDefectPPM

- VoseSixSigmaProbDefectShiftLower

- VoseSixSigmaProbDefectShiftUpper

- VoseSixSigmaYield

- VoseSixSigmaUpperBound

- VoseSixSigmaZupper

- VoseSixSigmaZmin

- VoseSixSigmaZlower

- Modeling expert opinion

- Modeling expert opinion introduction

- Sources of error in subjective estimation

- Disaggregation

- Distributions used in modeling expert opinion

- A subjective estimate of a discrete quantity

- Incorporating differences in expert opinions

- Modeling opinion of a variable that covers several orders of magnitude

- Maximum entropy

- Probability theory and statistics

- Probability theory and statistics introduction

- Stochastic processes

- Stochastic processes introduction

- Poisson process

- Hypergeometric process

- The hypergeometric process

- Number in a sample with a particular characteristic in a hypergeometric process

- Number of hypergeometric samples to get a specific number of successes

- Number of samples taken to have an observed s in a hypergeometric process

- Estimate of population and sub-population sizes in a hypergeometric process

- The binomial process

- Renewal processes

- Mixture processes

- Martingales

- Estimating model parameters from data

- The basics

- Probability equations

- Probability theorems and useful concepts

- Probability parameters

- Probability rules and diagrams

- The definition of probability

- The basics of probability theory introduction

- Fitting probability models to data

- Fitting time series models to data

- Fitting correlation structures to data

- Fitting in ModelRisk

- Fitting probability distributions to data

- Fitting distributions to data

- Method of Moments (MoM)

- Check the quality of your data

- Kolmogorov-Smirnoff (K-S) Statistic

- Anderson-Darling (A-D) Statistic

- Goodness of fit statistics

- The Chi-Squared Goodness-of-Fit Statistic

- Determining the joint uncertainty distribution for parameters of a distribution

- Using Method of Moments with the Bootstrap

- Maximum Likelihood Estimates (MLEs)

- Fitting a distribution to truncated censored or binned data

- Critical Values and Confidence Intervals for Goodness-of-Fit Statistics

- Matching the properties of the variable and distribution

- Transforming discrete data before performing a parametric distribution fit

- Does a parametric distribution exist that is well known to fit this type of variable?

- Censored data

- Fitting a continuous non-parametric second-order distribution to data

- Goodness of Fit Plots

- Fitting a second order Normal distribution to data

- Using Goodness-of Fit Statistics to optimize Distribution Fitting

- Information criteria - SIC HQIC and AIC

- Fitting a second order parametric distribution to observed data

- Fitting a distribution for a continuous variable

- Does the random variable follow a stochastic process with a well-known model?

- Fitting a distribution for a discrete variable

- Fitting a discrete non-parametric second-order distribution to data

- Fitting a continuous non-parametric first-order distribution to data

- Fitting a first order parametric distribution to observed data

- Fitting a discrete non-parametric first-order distribution to data

- Fitting distributions to data

- Technical subjects

- Comparison of Classical and Bayesian methods

- Comparison of classic and Bayesian estimate of Normal distribution parameters

- Comparison of classic and Bayesian estimate of intensity lambda in a Poisson process

- Comparison of classic and Bayesian estimate of probability p in a binomial process

- Which technique should you use?

- Comparison of classic and Bayesian estimate of mean "time" beta in a Poisson process

- Classical statistics

- Bayesian

- Bootstrap

- The Bootstrap

- Linear regression parametric Bootstrap

- The Jackknife

- Multiple variables Bootstrap Example 2: Difference between two population means

- Linear regression non-parametric Bootstrap

- The parametric Bootstrap

- Bootstrap estimate of prevalence

- Estimating parameters for multiple variables

- Example: Parametric Bootstrap estimate of the mean of a Normal distribution with known standard deviation

- The non-parametric Bootstrap

- Example: Parametric Bootstrap estimate of mean number of calls per hour at a telephone exchange

- The Bootstrap likelihood function for Bayesian inference

- Multiple variables Bootstrap Example 1: Estimate of regression parameters

- Bayesian inference

- Uninformed priors

- Conjugate priors

- Prior distributions

- Bayesian analysis with threshold data

- Bayesian analysis example: gender of a random sample of people

- Informed prior

- Simulating a Bayesian inference calculation

- Hyperparameters

- Hyperparameter example: Micro-fractures on turbine blades

- Constructing a Bayesian inference posterior distribution in Excel

- Bayesian analysis example: Tigers in the jungle

- Markov chain Monte Carlo (MCMC) simulation

- Introduction to Bayesian inference concepts

- Bayesian estimate of the mean of a Normal distribution with known standard deviation

- Bayesian estimate of the mean of a Normal distribution with unknown standard deviation

- Determining prior distributions for correlated parameters

- Improper priors

- The Jacobian transformation

- Subjective prior based on data

- Taylor series approximation to a Bayesian posterior distribution

- Bayesian analysis example: The Monty Hall problem

- Determining prior distributions for uncorrelated parameters

- Subjective priors

- Normal approximation to the Beta posterior distribution

- Bayesian analysis example: identifying a weighted coin

- Bayesian estimate of the standard deviation of a Normal distribution with known mean

- Likelihood functions

- Bayesian estimate of the standard deviation of a Normal distribution with unknown mean

- Determining a prior distribution for a single parameter estimate

- Simulating from a constructed posterior distribution

- Bootstrap

- Comparison of Classical and Bayesian methods

- Analyzing and using data introduction

- Data Object

- Vose probability calculation

- Bayesian model averaging

- Miscellaneous

- Excel and ModelRisk model design and validation techniques

- Using range names for model clarity

- Color coding models for clarity

- Compare with known answers

- Checking units propagate correctly

- Stressing parameter values

- Model Validation and behavior introduction

- Informal auditing

- Analyzing outputs

- View random scenarios on screen and check for credibility

- Split up complex formulas (megaformulas)

- Building models that are efficient

- Comparing predictions against reality

- Numerical integration

- Comparing results of alternative models

- Building models that are easy to check and modify

- Model errors

- Model design introduction

- About array functions in Excel

- Excel and ModelRisk model design and validation techniques

- Monte Carlo simulation

- RISK ANALYSIS SOFTWARE

- Risk analysis software from Vose Software

- ModelRisk - risk modeling in Excel

- ModelRisk functions explained

- VoseCopulaOptimalFit and related functions

- VoseTimeOptimalFit and related functions

- VoseOptimalFit and related functions

- VoseXBounds

- VoseCLTSum

- VoseAggregateMoments

- VoseRawMoments

- VoseSkewness

- VoseMoments

- VoseKurtosis

- VoseAggregatePanjer

- VoseAggregateFFT

- VoseCombined

- VoseCopulaBiGumbel

- VoseCopulaBiClayton

- VoseCopulaBiNormal

- VoseCopulaBiT

- VoseKendallsTau

- VoseRiskEvent

- VoseCopulaBiFrank

- VoseCorrMatrix

- VoseRank

- VoseValidCorrmat

- VoseSpearman

- VoseCopulaData

- VoseCorrMatrixU

- VoseTimeSeasonalGBM

- VoseMarkovSample

- VoseMarkovMatrix

- VoseThielU

- VoseTimeEGARCH

- VoseTimeAPARCH

- VoseTimeARMA

- VoseTimeDeath

- VoseTimeAR1

- VoseTimeAR2

- VoseTimeARCH

- VoseTimeMA2

- VoseTimeGARCH

- VoseTimeGBMJDMR

- VoseTimePriceInflation

- VoseTimeGBMMR

- VoseTimeWageInflation

- VoseTimeLongTermInterestRate

- VoseTimeMA1

- VoseTimeGBM

- VoseTimeGBMJD

- VoseTimeShareYields

- VoseTimeYule

- VoseTimeShortTermInterestRate

- VoseDominance

- VoseLargest

- VoseSmallest

- VoseShift

- VoseStopSum

- VoseEigenValues

- VosePrincipleEsscher

- VoseAggregateMultiFFT

- VosePrincipleEV

- VoseCopulaMultiNormal

- VoseRunoff

- VosePrincipleRA

- VoseSumProduct

- VosePrincipleStdev

- VosePoissonLambda

- VoseBinomialP

- VosePBounds

- VoseAIC

- VoseHQIC

- VoseSIC

- VoseOgive1

- VoseFrequency

- VoseOgive2

- VoseNBootStdev

- VoseNBoot

- VoseSimulate

- VoseNBootPaired

- VoseAggregateMC

- VoseMean

- VoseStDev

- VoseAggregateMultiMoments

- VoseDeduct

- VoseExpression

- VoseLargestSet

- VoseKthSmallest

- VoseSmallestSet

- VoseKthLargest

- VoseNBootCofV

- VoseNBootPercentile

- VoseExtremeRange

- VoseNBootKurt

- VoseCopulaMultiClayton

- VoseNBootMean

- VoseTangentPortfolio

- VoseNBootVariance

- VoseNBootSkewness

- VoseIntegrate

- VoseInterpolate

- VoseCopulaMultiGumbel

- VoseCopulaMultiT

- VoseAggregateMultiMC

- VoseCopulaMultiFrank

- VoseTimeMultiMA1

- VoseTimeMultiMA2

- VoseTimeMultiGBM

- VoseTimeMultBEKK

- VoseAggregateDePril

- VoseTimeMultiAR1

- VoseTimeWilkie

- VoseTimeDividends

- VoseTimeMultiAR2

- VoseRuinFlag

- VoseRuinTime

- VoseDepletionShortfall

- VoseDepletion

- VoseDepletionFlag

- VoseDepletionTime

- VosejProduct

- VoseCholesky

- VoseTimeSimulate

- VoseNBootSeries

- VosejkProduct

- VoseRuinSeverity

- VoseRuin

- VosejkSum

- VoseTimeDividendsA

- VoseRuinNPV

- VoseTruncData

- VoseSample

- VoseIdentity

- VoseCopulaSimulate

- VoseSortA

- VoseFrequencyCumulA

- VoseAggregateDeduct

- VoseMeanExcessP

- VoseProb10

- VoseSpearmanU

- VoseSortD

- VoseFrequencyCumulD

- VoseRuinMaxSeverity

- VoseMeanExcessX

- VoseRawMoment3

- VosejSum

- VoseRawMoment4

- VoseNBootMoments

- VoseVariance

- VoseTimeShortTermInterestRateA

- VoseTimeLongTermInterestRateA

- VoseProb

- VoseDescription

- VoseCofV

- VoseAggregateProduct

- VoseEigenVectors

- VoseTimeWageInflationA

- VoseRawMoment1

- VosejSumInf

- VoseRawMoment2

- VoseShuffle

- VoseRollingStats

- VoseSplice

- VoseTSEmpiricalFit

- VoseTimeShareYieldsA

- VoseParameters

- VoseAggregateTranche

- VoseCovToCorr

- VoseCorrToCov

- VoseLLH

- VoseTimeSMEThreePoint

- VoseDataObject

- VoseCopulaDataSeries

- VoseDataRow

- VoseDataMin

- VoseDataMax

- VoseTimeSME2Perc

- VoseTimeSMEUniform

- VoseTimeSMESaturation

- VoseOutput

- VoseInput

- VoseTimeSMEPoisson

- VoseTimeBMAObject

- VoseBMAObject

- VoseBMAProb10

- VoseBMAProb

- VoseCopulaBMA

- VoseCopulaBMAObject

- VoseTimeEmpiricalFit

- VoseTimeBMA

- VoseBMA

- VoseSimKurtosis

- VoseOptConstraintMin

- VoseSimProbability

- VoseCurrentSample

- VoseCurrentSim

- VoseLibAssumption

- VoseLibReference

- VoseSimMoments

- VoseOptConstraintMax

- VoseSimMean

- VoseOptDecisionContinuous

- VoseOptRequirementEquals

- VoseOptRequirementMax

- VoseOptRequirementMin

- VoseOptTargetMinimize

- VoseOptConstraintEquals

- VoseSimVariance

- VoseSimSkewness

- VoseSimTable

- VoseSimCofV

- VoseSimPercentile

- VoseSimStDev

- VoseOptTargetValue

- VoseOptTargetMaximize

- VoseOptDecisionDiscrete

- VoseSimMSE

- VoseMin

- VoseMin

- VoseOptDecisionList

- VoseOptDecisionBoolean

- VoseOptRequirementBetween

- VoseOptConstraintBetween

- VoseSimMax

- VoseSimSemiVariance

- VoseSimSemiStdev

- VoseSimMeanDeviation

- VoseSimMin

- VoseSimCVARp

- VoseSimCVARx

- VoseSimCorrelation

- VoseSimCorrelationMatrix

- VoseOptConstraintString

- VoseOptCVARx

- VoseOptCVARp

- VoseOptPercentile

- VoseSimValue

- VoseSimStop

- Precision Control Functions

- VoseAggregateDiscrete

- VoseTimeMultiGARCH

- VoseTimeGBMVR

- VoseTimeGBMAJ

- VoseTimeGBMAJVR

- VoseSID

- Generalized Pareto Distribution (GPD)

- Generalized Pareto Distribution (GPD) Equations

- Three-Point Estimate Distribution

- Three-Point Estimate Distribution Equations

- VoseCalibrate

- ModelRisk interfaces

- Integrate

- Data Viewer

- Stochastic Dominance

- Library

- Correlation Matrix

- Portfolio Optimization Model

- Common elements of ModelRisk interfaces

- Risk Event

- Extreme Values

- Select Distribution

- Combined Distribution

- Aggregate Panjer

- Interpolate

- View Function

- Find Function

- Deduct

- Ogive

- AtRISK model converter

- Aggregate Multi FFT

- Stop Sum

- Crystal Ball model converter

- Aggregate Monte Carlo

- Splicing Distributions

- Subject Matter Expert (SME) Time Series Forecasts

- Aggregate Multivariate Monte Carlo

- Ordinary Differential Equation tool

- Aggregate FFT

- More on Conversion

- Multivariate Copula

- Bivariate Copula

- Univariate Time Series

- Modeling expert opinion in ModelRisk

- Multivariate Time Series

- Sum Product

- Aggregate DePril

- Aggregate Discrete

- Expert

- ModelRisk introduction

- Building and running a simple example model

- Distributions in ModelRisk

- List of all ModelRisk functions

- Custom applications and macros

- ModelRisk functions explained

- Tamara - project risk analysis

- Introduction to Tamara project risk analysis software

- Launching Tamara

- Importing a schedule

- Assigning uncertainty to the amount of work in the project

- Assigning uncertainty to productivity levels in the project

- Adding risk events to the project schedule

- Adding cost uncertainty to the project schedule

- Saving the Tamara model

- Running a Monte Carlo simulation in Tamara

- Reviewing the simulation results in Tamara

- Using Tamara results for cost and financial risk analysis

- Creating, updating and distributing a Tamara report

- Tips for creating a schedule model suitable for Monte Carlo simulation

- Random number generator and sampling algorithms used in Tamara

- Probability distributions used in Tamara

- Correlation with project schedule risk analysis

- Pelican - enterprise risk management